Inflation is a concern for the GCC, but it has faced far worse before

Global inflation trends

Inflation is one of the leading economic issues on the minds of economists, policymakers, business and the general public at the moment. Energy prices have risen by more than expected and some of the pandemic-sparked supply chain disruptions have persisted into 2022, presenting a particular challenge for heavily import-dependent countries like the Gulf states. US inflation hit a 40-year high of 7% and the IMF’s World Economic Outlook in January forecast that advanced economies will see 3.9% inflation in 2022, nearly double the level it had expected only three months earlier.

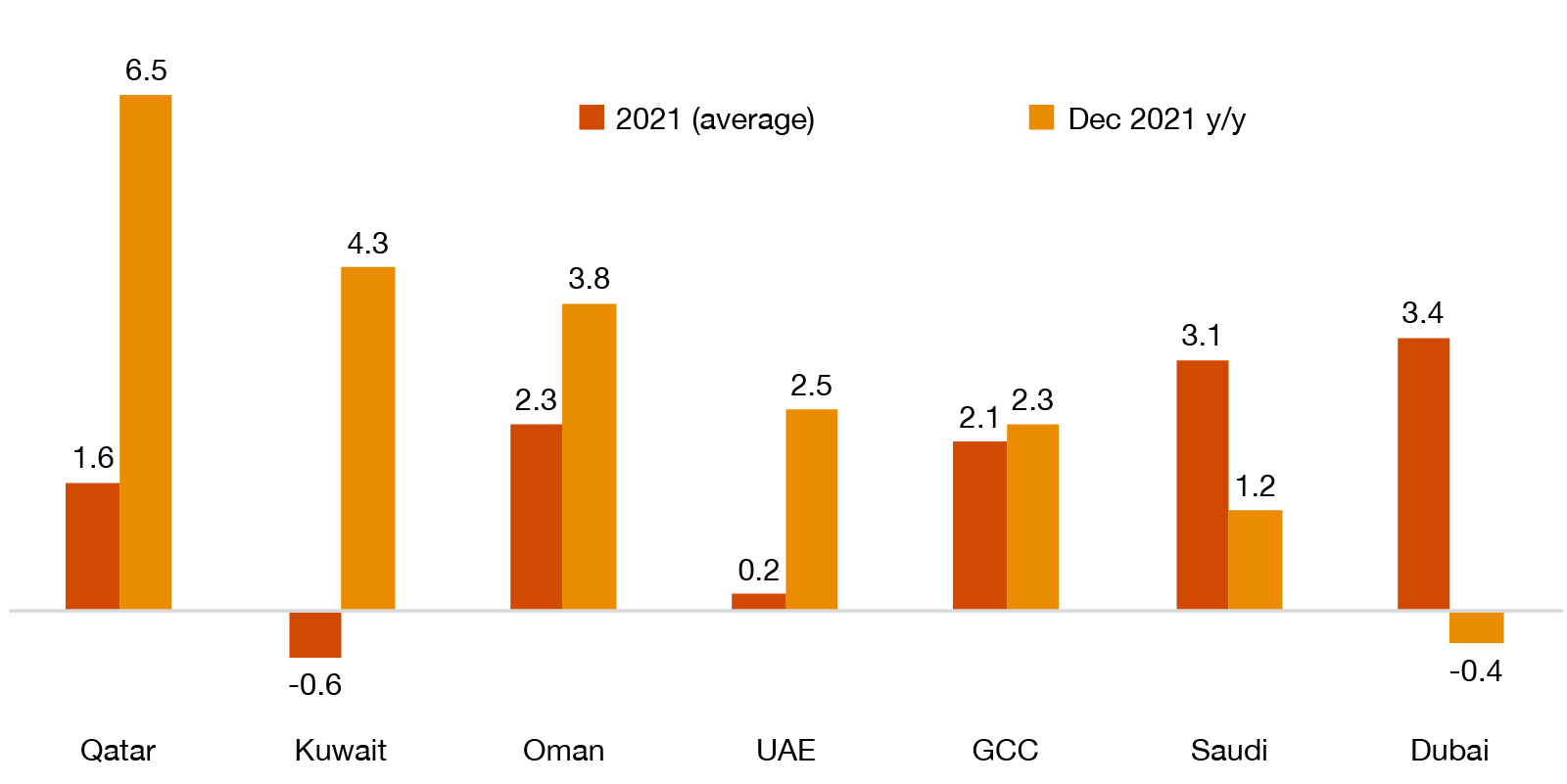

The GCC states have not been immune to this global trend, although the picture in the region is complicated and varies widely between countries. In December, inflation ranged from a high of 6.5% in Qatar, the highest it has seen since 2008, to -0.4% deflation in Bahrain. In November, the last month for which data was available for Oman and Kuwait at the time of writing, the regional average was 2.2%, when weighed using 2020 non-oil GDP. This is the most since 2018 but not high by historical standards and far below the inflationary spike in 2008 when the GCC’s annual average rate was 11%.

GCC inflation (%)

Source: National statistical agencies

Transport drives inflation while rents are a drag

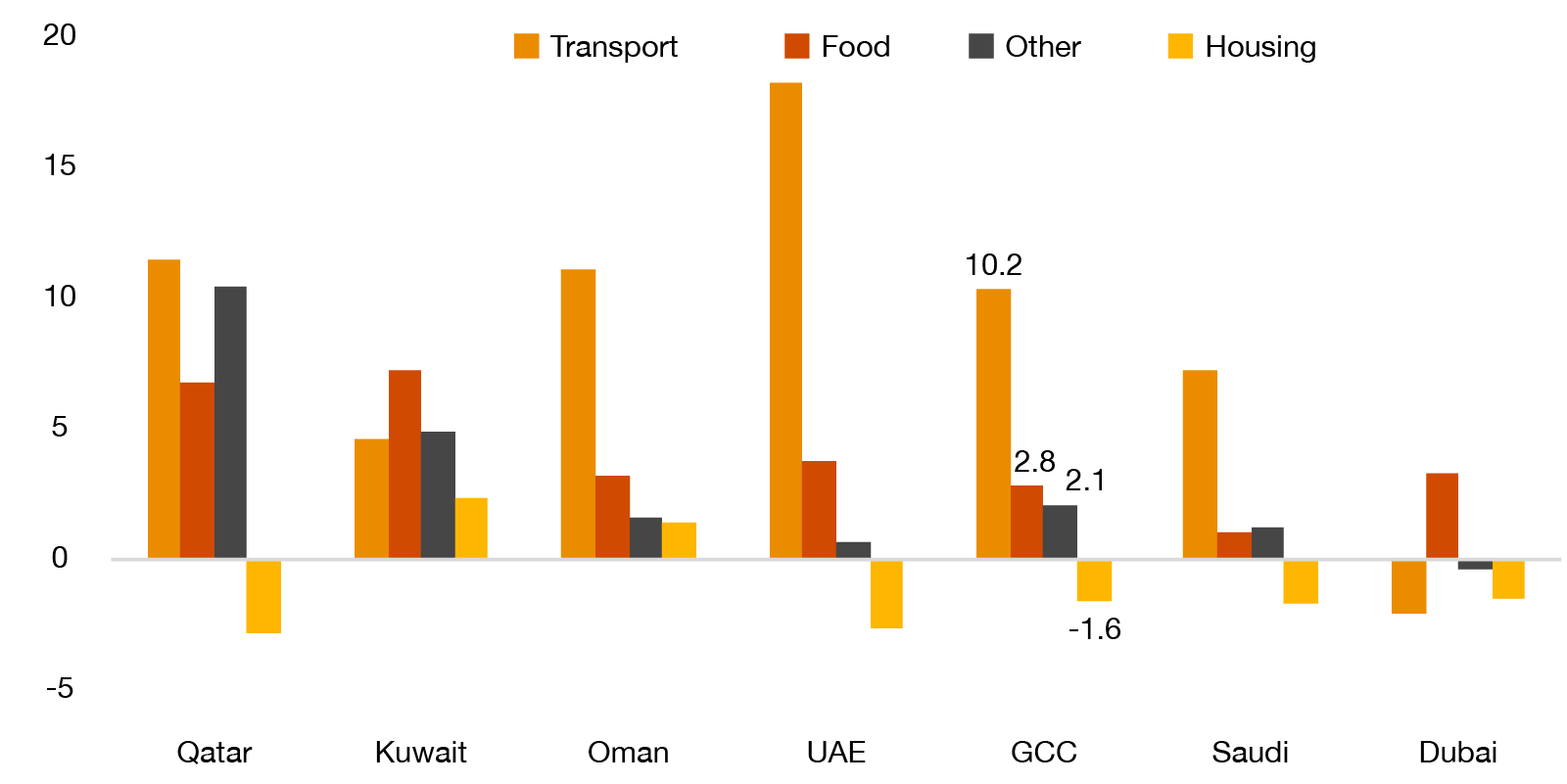

Although there are some common themes in the factors driving inflation, there is also considerable divergence, if we look at the major components of the consumer price index—Rent, food and transport—which comprise 57% of the GCC’s overall consumption basket and as much as 70% in Oman.

Transport is the major driver, up 10.2% y/y in the GCC on average because of the increase in prices of fuel and also vehicles (given the global microchip shortages). The UAE is registering the highest rate, at 18% y/y in December. Bahrain, however, actually saw a -2.0% y/y decline, partly because its fuel prices are still fixed under a subsidy system, as they are in Kuwait, whereas other GCC states now set prices at the pump each month based on global oil prices. Back in 2008, fuel subsidies meant that transport wasn’t a major contributor to inflation in the GCC, although high oil prices drove up shipping and import costs, an indirect factor that is also contributing to the current cycle.

Surprisingly, food prices are only up by 3.0% on average, only slightly above overall inflation. This is despite the region being heavily reliant on imports and global food inflation reaching the most in a decade, with the FAO’s food index up by 20% y/y in January. This contrasts with the 2008 spike, when food prices were up by 15%, sparking frenzied policies such as GCC sovereign wealth funds buying up farmland in Africa to try and secure supplies. Most of those investments didn’t persist, but the GCC states did make preparations to avert another food crisis, such as building up strategic reserves and local production capacity, which may explain why food inflation has been more muted this time around.

Another difference from 2008 is that rents (the main component of housing costs) are declining in most of the region, whereas back then there was high-double digit inflation. This is because, in 2008, inflation in the GCC was driven not only by global trends but by the region’s historic population boom and consequent pressure on supply. The GCC’s population rose by 8% that year, led by the UAE with a remarkable 30% increase. Today, however, the expatriate population is flat or declining in most countries due to both nationalisation policies and the impact of the pandemic on sectors such as hospitality. Although housing is the largest component of the CPI across the GCC, its weight ranges from 21% in Qatar to 33% in Kuwait (as determined through periodic household expenditure surveys).

Inflation components (% y/y, Nov 2021)

Source: Statistical agencies; PwC analysis

Lockdowns distort prices for holidays and education

The headline data belie some interesting trends, including quirks resulting from pandemic lockdowns that may be skewing the data in a misleading way. This is either because certain items were temporarily not for sale or statistical agencies were unable to collect price data using their normal systems.

The best example of this is “package holidays”, a sub-component of the recreation and culture line in the CPI, which saw sales largely halted as a result of travel restrictions. Most countries don’t release a detailed breakdown in their monthly inflation data, but Bahrain does and for the first year after the onset of Covid, this series was down sharply, bottoming at -73% y/y in September 2021. This is unlikely to mean that a package holiday that was on sale in 2020 could actually be purchased for a quarter of the 2019 price, but rather that the price discovery mechanism had temporarily broken down. As things return to normal, so is price discovery, which is likely exaggerating inflation in items like this. For Bahrain, package holidays only comprise 2.8% of the CPI, but the 96% y/y increase in November meant that this one item contributed 2.6 percentage points to overall inflation, which was 0.7%, meaning that without package holidays there would have actually been a deflationary reading of -1.9%. The impact is even more extreme in Qatar where package holidays comprise 9% of the entire CPI, triple the level of any other GCC state and representing more than education and healthcare combined. This is probably an excessively large weight relative to actual household spending. Qatar doesn’t regularly publish a CPI breakdown showing package holidays, but the broader recreation and culture component, of which it is a part, was up by 37% y/y in December, contributing to about 4.2 percentage points of the overall 6.5% inflation. This implies inflation excluding package holidays would have been much lower and helps explain why Qatar’s high inflation currently looks like such an outlier in the Gulf.

Another case in point is education costs in Kuwait. Many Gulf statistical agencies only update their education costs at the start of the new school year. The disruption the pandemic caused to education resulted in Kuwait’s education costs being recorded as declining by -16% m/m in September 2020 and then holding flat until September 2021 when they rebounded by 19% m/m to just above their level in the 2019/20 academic year. This means that education, although only weighted at 4% of the consumer price basket, is responsible for a quarter of Kuwait’s current inflation reading.

Economists expect inflation to ease in 2022

The IMF’s October forecasts, albeit now slightly dated, saw GCC inflation easing to 2.4% in 2022 and the Arab Monetary Fund’s November forecast put it even lower, at 2.1%. More recent forecasts also see only modest inflation, with the median of economists surveyed by Reuters in January giving a range from 2.0% for Saudi Arabia and UAE to 2.8% for Qatar.

The main reason to think inflation will follow these forecasts is that pandemic-related constraints should ease as the Omicron wave subsides and the effects of temporary pricing distortions, such as for package holidays and education, should fade. An easing in energy prices would also help with transportation costs. The recent strengthening of the US dollar, given pegged currencies in the GCC, should also help mitigate imported inflation.

However, set against this is the recent poor track record of inflation forecasts in even the most closely studied economies, such as the US, where many, including the Federal Reserve, saw inflation as transitory, whereas in fact supply chain disruptions are persisting longer than anticipated. There could also be new inflationary pressures in the GCC including a broader lagged impact from the global food price increase, which is already visible in Qatar and Kuwait, and a return of rental inflation, tracking the turnaround in real estate prices in the UAE and elsewhere. There are also country-specific factors such as the impact of VAT in Bahrain (which should add about 3% to inflation) and the World Cup in Qatar. Therefore, policymakers and businesses in the Gulf can hope for an easing in inflation but should not be complacent and need to prepare for the worst.

GCC states have some policy levers to manage inflation

The consensus view across most global central banks (outside of Turkey) is that lower interest rates boost demand, by encouraging borrowing-to-spend behaviour by consumers and companies, thereby driving up prices, all else being equal. This is why many countries are once again beginning to increase rates, which were cut low to stimulate demand at the start of the pandemic. The US Federal Reserve has indicated that it will start raising rates, precisely because of inflation concerns, and the GCC states are expected to follow in lockstep. The rises are likely to begin in March and could see increases of between 75-150 basis points this year.

The most direct way to limit inflation is to control prices. Subsidy regimes in the GCC held back inflation for many years, but many aspects of them have been withdrawn since 2016. However, some subsidies do remain and are even being expanded. Oman has capped fuel prices at the November level and in January rejigged its electricity subsidy regime in a way that has reduced costs for most residential consumers, a disinflationary driver.

Governments can also set limits on the prices that private companies can charge for certain goods and services. This is generally discouraged by economists but is common in areas such as healthcare, education and basic foodstuffs. At the start of the regional trade boycott of Qatar in 2017, its ministry of commerce temporarily fixed prices for many foodstuffs to prevent price gouging as a result of temporary shortages. This didn’t last long, as alternative trade routes were developed. However, it provides an example of a possible policy GCC states could choose to deploy if prices do get out of hand again. Kuwait also fixed various food prices in March 2020 and is preparing to lift these restrictions, creating concerns of additional inflationary pressure. A longer-term strategy is to boost strategic reserves of key imported goods, from food to construction materials, to help ride out temporary price spikes.

Meanwhile, it has already been noted that taxation can be inflationary, at least in the first 12 months after the rate has been changed. By the same measure, tax reduction can be deflationary. Saudi Arabia indicated last year that it intends to reduce its VAT from the current rate of 15%, which was introduced as a temporary fiscal measure in 2020. No indication has been given on when this cut will be implemented, but it could be done suddenly and would help to reduce inflation, along with other benefits.

Contact us

Richard Boxshall

Global Economics Leader and Middle East Chief Economist, PwC Middle East

Tel: +971 (0)4 304 3100